Ethereum Price Prediction: Technical Breakout Potential Amid Institutional Accumulation

#ETH

- ETH trading above 20-day MA indicates underlying bullish momentum despite MACD bearish signals

- Institutional accumulation offsetting retail outflows, with major players expanding ETH holdings significantly

- Technical setup suggests $4,500-$4,800 target range, supported by growing ecosystem adoption and regulatory clarity advancements

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

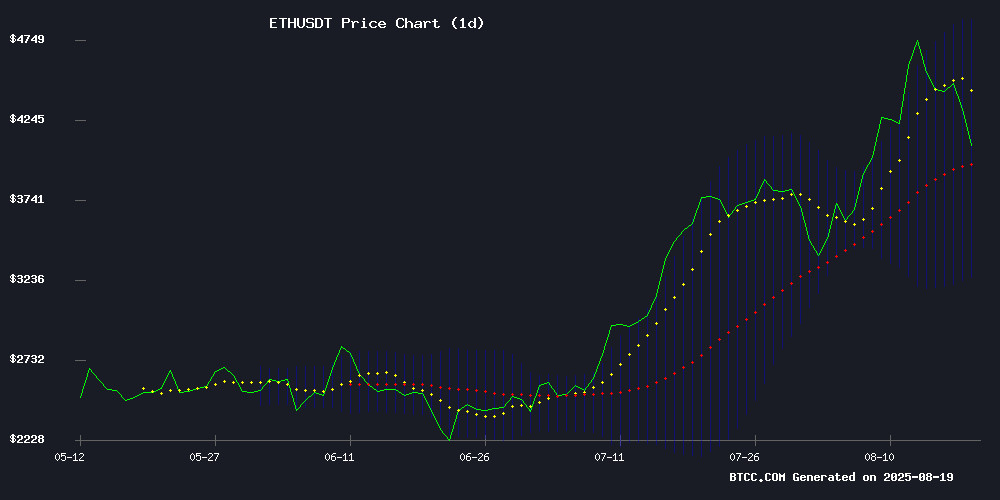

Ethereum is currently trading at $4,176.22, holding comfortably above its 20-day moving average of $4,072.87, indicating underlying strength in the current market structure. According to BTCC financial analyst Michael, 'The price position relative to the moving average suggests buyers remain in control despite recent volatility.'

The MACD reading of -421.08 versus -303.13 shows bearish momentum, but the narrowing spread suggests potential trend reversal. Bollinger Bands position with current price between middle ($4,072.87) and upper band ($4,887.38) indicates room for upward movement before reaching overbought territory.

Market Sentiment: Institutional Accumulation Offsets Short-Term Outflows

Recent news FLOW presents a mixed but fundamentally constructive picture for Ethereum. While headlines highlight whale exodus and ETF outflows, BTCC financial analyst Michael notes that 'institutional phase adoption continues with significant corporate accumulation, as evidenced by SharpLink's $537M ETH war chest and Wynn's substantial position.'

The expansion of Polygon's network activity and Japan's entry into licensed stablecoin issuance demonstrates growing ecosystem maturity. Michael adds, 'Validator exit queues hitting record levels actually reflect sophisticated staking strategies rather than bearish sentiment, as institutions optimize yield opportunities.'

Factors Influencing ETH's Price

SharpLink Gaming Expands Ethereum Holdings to 740,760 ETH with $537M War Chest

SharpLink Gaming, Inc. (Nasdaq: SBET) has solidified its position as one of the largest corporate holders of Ether, acquiring an additional 143,593 ETH at an average price of $4,648. The purchase brings its total holdings to 740,760 ETH, underscoring a aggressive treasury strategy initiated on June 2.

The company raised $537 million through a combination of at-the-market offerings and a registered direct offering, fueling its rapid accumulation of Ethereum. Staking rewards have already yielded 1,388 ETH, demonstrating the dual strategy of capital appreciation and yield generation.

"SharpLink is aligning itself with Ethereum’s future as a global financial infrastructure," the company stated, positioning its moves as a direct bet on the blockchain’s long-term viability. The scale of accumulation suggests institutional confidence in ETH’s role beyond speculative trading.

Ethereum Faces Whale Exodus and ETF Outflows Amid Price Decline

Ethereum's market sentiment has turned sharply bearish as large holders accelerate sell-offs. Blockchain analytics reveal $148 million in ETH moved to exchanges within hours, with notable transfers to Coinbase and Binance. The panic-selling follows a broader trend of institutional divestment, as ETH ETFs bled $196.6 million in single-day outflows—the second-worst daily performance on record.

Technical indicators show ETH trading within a descending channel, though some traders speculate about a potential rebound toward $4,500. The simultaneous retreat of crypto whales and traditional finance investors suggests weakening conviction, with the altcoin now testing critical support levels. Market observers note this marks a stark reversal from earlier accumulation patterns.

R0AR Announces Node Sale to Democratize Layer 2 Infrastructure

R0AR, a unified DeFi super-app built on Optimism’s OP Stack, has launched a Node Sale program aimed at decentralizing LAYER 2 infrastructure. Starting August 25, 2025, participants worldwide can purchase validator node licenses, earning rewards while securing the R0ARchain network.

The initiative addresses centralization in Layer 2 solutions, where institutional validators dominate. By enabling community-owned infrastructure, R0AR combines Ethereum’s security with broader participation. "We’re flipping the model," says CTO Dustin Hedrick, emphasizing financial sovereignty.

Ethereum Investors Hold Firm Despite Pullback from $4,700

Ethereum's rally stalled NEAR $4,700, triggering a correction that sent prices below $4,500. Yet the retreat hasn't shaken investor conviction—Glassnode's on-chain data reveals accumulating bids at $4,400, signaling strategic dip-buying rather than panic selling.

Market participants across institutional and retail cohorts continue treating ETH as a Core holding. The altcoin's cost basis heatmap shows concentrated demand at current levels, with traders viewing the pullback as an entry opportunity rather than a trend reversal.

Polygon Hits Annual High in Value Locked as Network Activity Surges

Polygon, a foundational ethereum Layer-2 scaling solution, has surged to its highest total value locked (TVL) this year, crossing $1.25 billion—a threshold last seen in 2023. The network's resurgence is fueled by resurgent DeFi activity, Polymarket integrations, and renewed confidence in its infrastructure.

Year-to-date, Polygon's TVL has climbed 43%, supported by $2.77 billion in native and bridged stablecoins. The chain recently led all competitors in 24-hour inflows, absorbing $12 million in bridged deposits as DeFi protocols and lending platforms proliferate. Once a hub for NFT and gaming projects during the 2021 bull run, Polygon now thrives as a low-cost conduit for micropayments and token transfers.

Despite a dip in daily active users over the past quarter, niche applications like Polygon WiFi Map show pockets of growth. The network's early-mover advantage in Ethereum scaling continues to pay dividends during the 2025 market expansion.

Ethereum Whale Buying: New ATH or Liquidation? Wynn’s 25X ETH Bet

The crypto market is abuzz with speculation as Ethereum whale James Wynn takes a highly leveraged 25X long position on ETH, setting a liquidation price at $4,152. This aggressive move has traders debating whether it signals confidence in a new all-time high or risks a cascading liquidation event.

Wynn, one of the most closely monitored whales in the space, has a history of market-moving positions. The size and leverage of this trade suggest either conviction in Ethereum's upside potential or a high-stakes gamble that could exacerbate volatility.

Ethereum Validator Exit Queue Hits Record $3.9B Amid Staking Shifts

Ethereum's validator exit queue has surged to a record $3.9 billion, marking the highest level since the network transitioned to proof-of-stake in 2022. Current estimates suggest a 16-day waiting period for withdrawals, with Lido and Coinbase driving nearly 55% of the outflow demand.

Validator Queue data reveals a 70% spike in exit requests over the past fortnight, peaking at 700,000 ETH in late July. Meanwhile, new staking entries have declined to 200,000 ETH, creating the largest imbalance since Shanghai upgrade enabled withdrawals.

The trend underscores growing institutional repositioning as staking rewards normalize post-Merge. Market watchers note the exit pressure remains contained—representing just 1.3% of staked ETH—but could impact short-term liquidity dynamics.

Japan’s First Licensed Yen Stablecoin Issuer JPYC Aims to Emulate Circle

JPYC, Japan’s inaugural licensed stablecoin issuer, has positioned itself as the nation’s answer to Circle, marking a pivotal moment for the country’s digital asset sector. The firm secured registration under Japan’s amended Payment Services Act, enabling it to issue yen-backed electronic money tokens on Ethereum, Avalanche, and Polygon. A non-custodial model will empower users to hold their own assets, with identity verification tied to Japan’s My Number card IC chip for robust KYC compliance.

Reserves exceeding 101% of the stablecoin’s value will be held in Japanese government bonds and trust deposits, with JPYC projecting annual gross profits of ¥5 billion ($34 million) per ¥1 trillion ($6.8 billion) issued. The initial reserve allocation favors government bonds (80%) over deposits (20%), though longer-term bonds may dominate later. Domestic users will be the primary focus, as My Number card requirements exclude overseas participants.

The stablecoin’s launch aligns with Japan’s push to regulate digital assets under its revised Payment Services Act. Authorities retain the ability to freeze transactions flagged as illicit via court or police requests, underscoring the balance between innovation and oversight.

Ethereum Corrects in Double Three Wave Pattern Amid Bullish Momentum

Ethereum completed a five-wave impulse structure from its August 2025 low, peaking at $4,791.5 in wave ((v)) and solidifying its bullish trajectory. The rally showcased consistent momentum, with intermediate waves ((i)) to ((iv)) establishing higher highs and higher lows—a classic hallmark of strong uptrends in technical analysis.

The current corrective phase (wave 2) is unfolding as a double three Elliott Wave pattern, a common consolidation structure after sharp advances. Key levels to watch include the $3,895–$4,156.2 Fibonacci confluence zone, where institutional buyers historically step in. A rejection from this support band could reignite the upward trend, while a breakdown WOULD signal deeper retracement.

Traders are monitoring the 60-minute chart for confirmation of either scenario, with particular attention to whether wave (c) of ((y)) exhausts within the projected target range. The resolution of this correction will determine whether ETH resumes its primary bullish count or requires structural reassessment.

Ethereum Enters Institutional Phase Amid Regulatory Uncertainty

Ethereum's price consolidation near $4,800 belies a deeper transformation underway. The asset is transitioning into its institutional era, with investment funds now holding 6.1 million ETH—a 68.4% increase from December 2024 levels. The Fund Market Premium has surged to 6.44%, marking a 2,047% jump from previous benchmarks.

Regulatory clarity remains the missing piece. The proposed CLARITY Act in the United States could accelerate Ethereum's maturation by classifying it as a digital commodity. Meanwhile, CryptoQuant data reveals institutional holdings now represent nearly 75% of April 2025 lows, signaling growing confidence among sophisticated investors.

Ethereum Faces Rejection at Key Historical Resistance Level

Ethereum's rally abruptly reversed with a 10% drop after encountering a critical on-chain resistance level. Glassnode data reveals the $4,700 mark—representing +1 standard deviation above Ethereum's Active Realized Price—has repeatedly capped upside momentum during previous market cycles.

The Active Realized Price metric, which excludes dormant coins to reflect the average cost basis of active investors, currently sits below spot prices. This suggests most holders remain in profit despite the recent pullback. Historical patterns indicate such rejections at this technical threshold often precede extended consolidation periods.

How High Will ETH Price Go?

Based on current technical positioning and fundamental developments, ETH shows potential for movement toward the $4,500-$4,800 range in the near term. The combination of institutional accumulation, growing Layer 2 adoption, and technical support above key moving averages creates a favorable setup.

| Target Level | Probability | Key Drivers |

|---|---|---|

| $4,500 | High | Institutional accumulation, technical breakout |

| $4,800 | Medium | Bollinger upper band, ETF inflows resumption |

| $5,200+ | Low | Requires broader crypto market rally |

Michael emphasizes that 'while short-term outflows create noise, the structural adoption story remains intact, with $4,000 now acting as critical support.'